Emerald Insights #123: 2025 Cannabis License Leaderboards

Emerald Insights is the new name of the Cannacurio blog series, the industry’s trusted source for timely, data-driven analysis of cannabis licensing and regulatory trends.

Executive Summary

2025 marked a year of adaptation and normalization for the U.S. cannabis industry. After several years of rapid expansion and regulatory experimentation, license activity increasingly reflected localized market conditions rather than broad national growth. While the industry continued to contend with price compression, litigation, and shifting federal signals, state regulators remained focused on the operational work of issuing licenses, processing renewals, and enforcing compliance.

The data from 2025 reinforces a central theme of the normalization era: overall contraction at the national level, offset by continued activity in a small number of states. New license issuance slowed meaningfully, total active licenses declined, and the balance between cultivation, manufacturing, and retail remained strikingly consistent—suggesting structural equilibrium rather than cyclical expansion.

Key Findings (2025)

- 4,372 new cannabis licenses were issued across all regulated activities in 2025 (excluding Oklahoma and Oregon), down from 2024 levels.

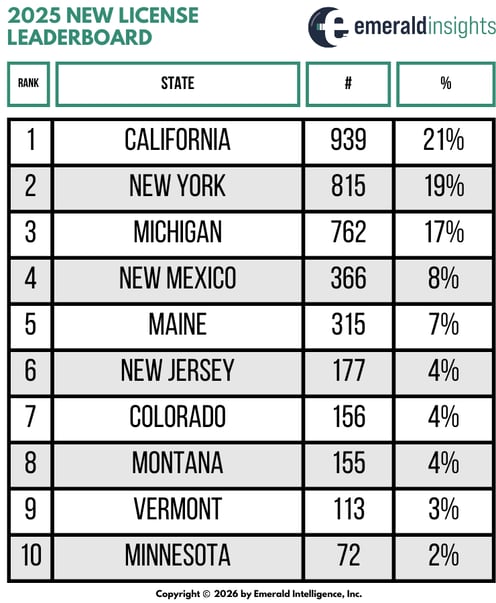

- Four states accounted for 66% of all new licenses issued during the year, with California leading the nation.

- The total number of active cannabis licenses declined to 37,824, down from 39,715 at year-end 2024, representing a 76% net contraction once churn is accounted for.

Cultivation, manufacturing, and retail licenses again represented approximately 90% of all new licenses issued, reinforcing the long-running pattern that the industry continues to recreate the same activity mix year after year—even as total license counts decline.

License Mix: Cultivation, Manufacturing, and Retail

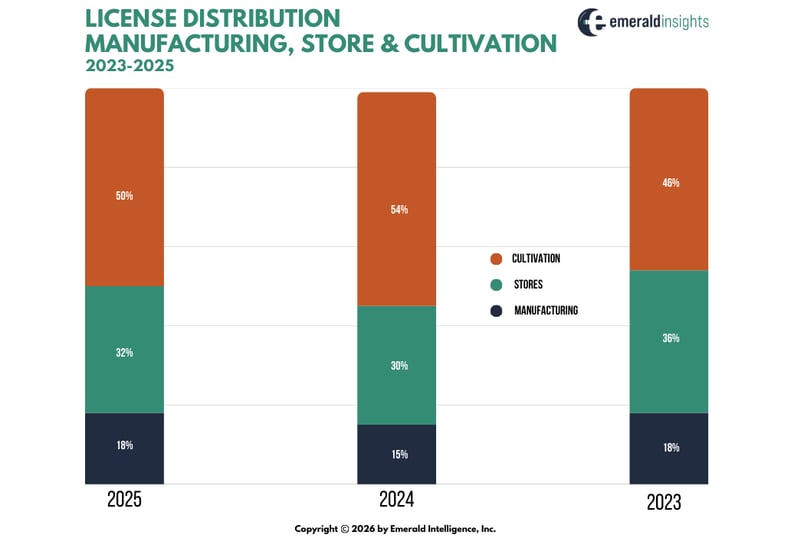

The relative balance among the three primary license categories shifted modestly in 2025 but remained broadly consistent with prior years:

- Cultivation licenses: 50% of new licenses issued (down from 54% in 2024)

- Retail / dispensary licenses: 32% (up slightly from 30%)

- Manufacturing licenses: 18% (up from 15%)

These incremental changes underscore a defining feature of the normalization era: even as markets contract, regulators and operators continue to reproduce a familiar supply-chain structure. The persistence of this balance has important implications for pricing, margins, and long-term sustainability, particularly in cultivation-heavy states.

State Leaderboard: All License Types

License issuance in 2025 was highly concentrated geographically. California moved into the top position, rising from fourth place in 2024 to lead all states in total new licenses issued.

- 62% of California’s new licenses were for cultivation

- 14% were retail licenses

- 5% were manufacturing licenses

New York’s license mix appeared to show only 5% cultivation licenses; however, the state issued 116 microbusiness licenses, all of which permit cultivation activity. This highlights the importance of interpreting headline activity categories in the context of state-specific license structures.

Activities Overview

While states issue many different types of cannabis licenses, cultivation, manufacturing, and retail remain the core activities in every regulated market. Together, they account for roughly 90% of licenses issued annually and provide the most consistent lens through which to assess structural change.

Cultivation

Cultivation licenses continue to dominate the U.S. cannabis license landscape. At year-end 2025, 45% of all active cannabis licenses were cultivation licenses. Not all are operational, and numerous regulators and economists have documented persistent oversupply across mature markets.

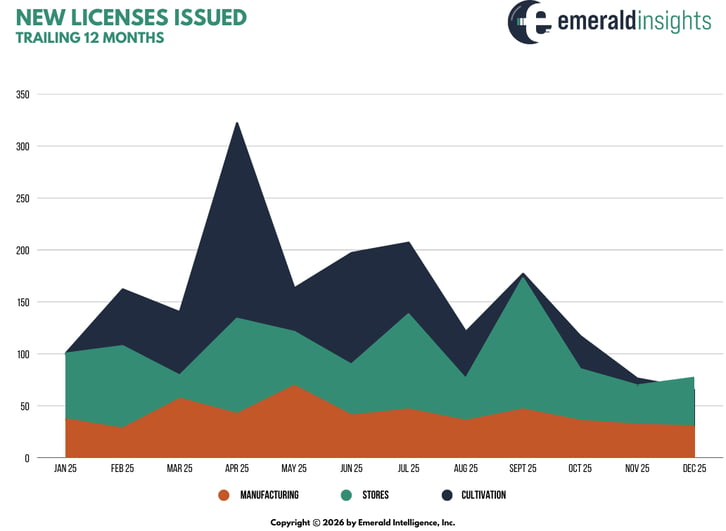

In 2025, the number of active cultivation licenses declined meaningfully:

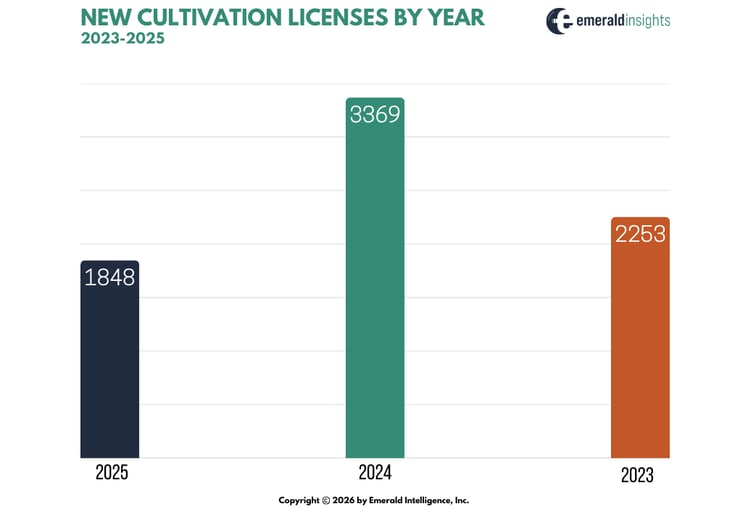

- 1,848 new cultivation licenses were issued, down from 3,369 in 2024.

- Total active cultivation licenses fell from 18,630 in January to 17,013 in December, a decline of 6%.

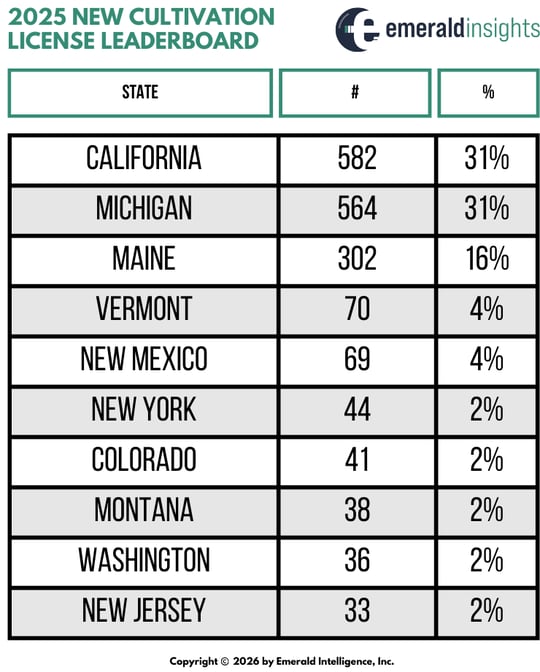

- California added 582 new cultivation licenses, with Michigan close behind at 564.

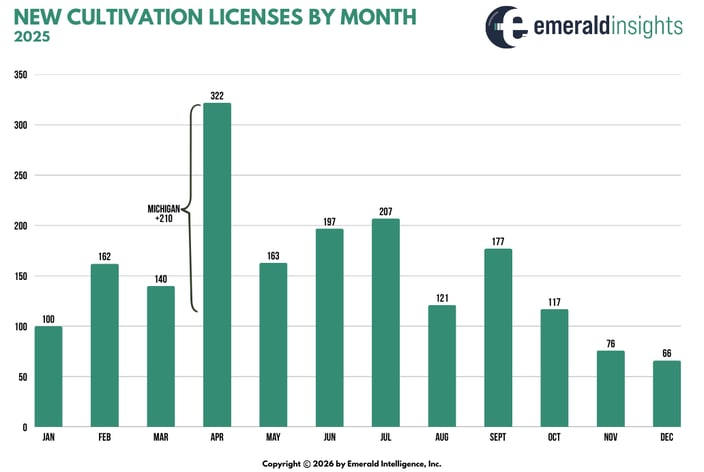

Monthly issuance data shows new cultivation licenses generally ranged between 100 and 200 per month, with a notable spike in April driven by Michigan. Issuance tapered in the fourth quarter, reinforcing broader contraction trends.

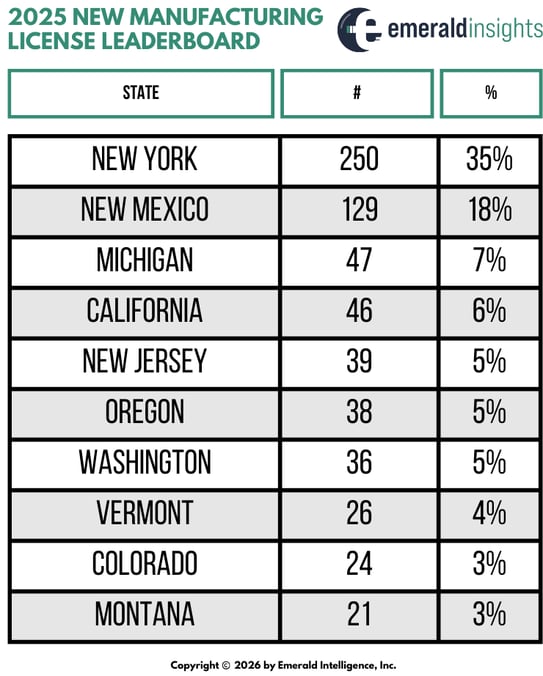

Manufacturing

Manufacturing licenses remained the least volatile activity category in 2025, though issuance and facility counts both declined.

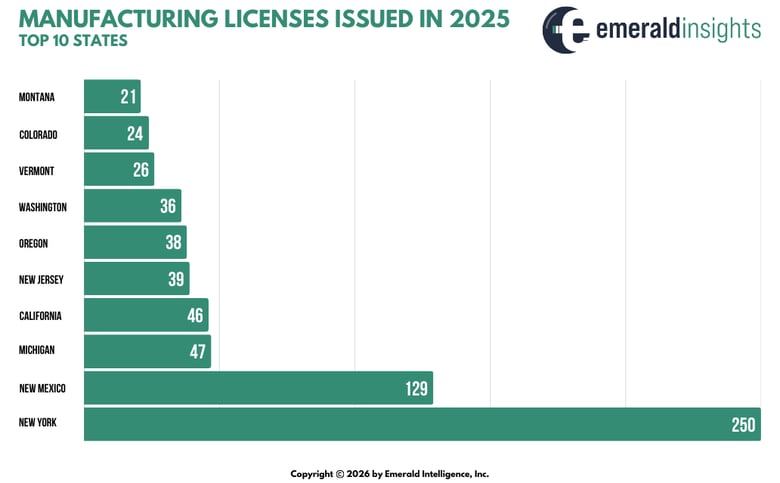

- 677 new manufacturing licenses were issued, down from 893 in 2024.

- New York led the nation with 250 licenses (35%), followed by Michigan with 129 (18%).

- Total manufacturing facilities declined from 5,960 to 5,629, a 5% decrease.

The relative stability of manufacturing compared to cultivation and retail continues to position it as a moderating force within the cannabis value chain.

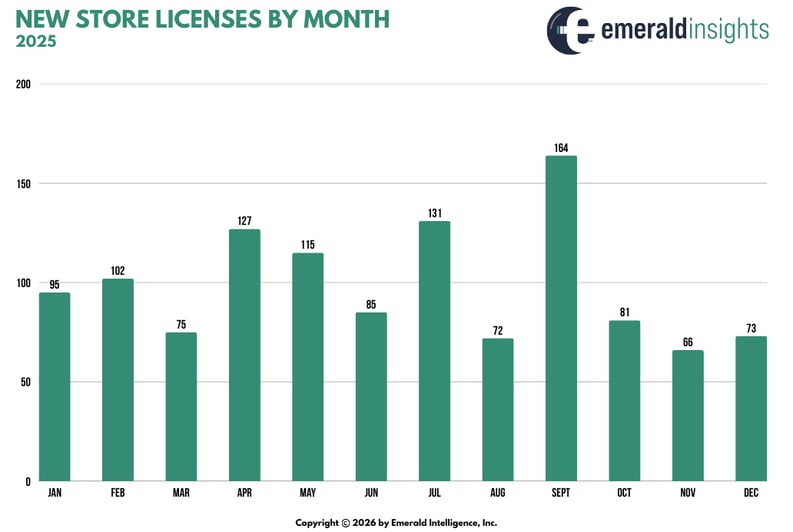

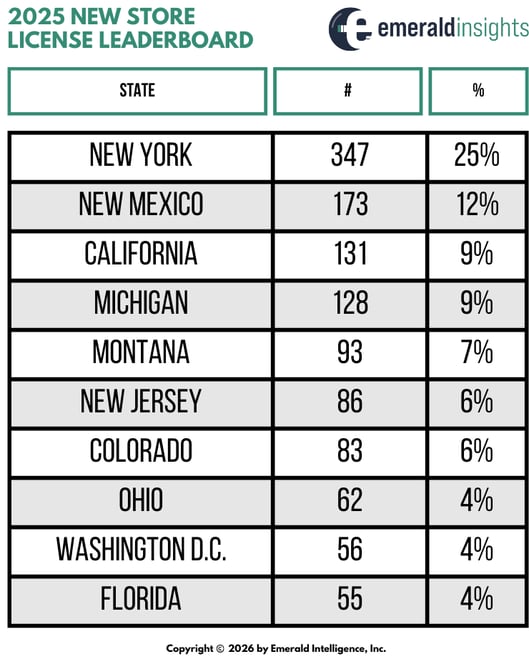

Dispensary / Retail

Retail licenses remain the most visible—and often most scrutinized—activity in cannabis markets. As the primary customer-facing license, dispensaries also face growing competition from illicit operators and adjacent retail formats such as smoke, vape, and CBD shops. In 2025:

- 1,402 new store licenses were issued nationwide.

- New York again led the nation with 347 new licenses, down from 533 in 2024.

- The top four states accounted for 56% of new retail licenses, slightly below 2024 levels.

Retail issuance continued, but at a slower pace, consistent with saturation dynamics in mature markets.

Conclusion

The 2025 data confirms that the U.S. cannabis industry has entered a normalization era. Total license counts declined, new issuance slowed, and activity became increasingly concentrated in a small number of jurisdictions. Rather than signaling retrenchment across the board, these trends reflect a market adjusting to structural realities—pricing pressure, regulatory maturity, and constrained capital.

As normalization continues, the most meaningful changes are likely to occur at the state level, shaped by program design, enforcement posture, and market demand rather than national expansion cycles.

Author

Ed Keating spearheads Emerald Intel’s engagement with regulators worldwide, gathering and analyzing corporate, financial, and licensing data to map the evolving cannabis landscape. He is the author of the Emerald Insights blog and host of the Cannacurio podcast. Ed holds a degree from Hamilton College and earned his MBA from the Kellogg School of Management at Northwestern University. He currently serves as Chief Economist at Emerald Intel.

Emerald Insights is an episodic column from Emerald Intel featuring insights from the most comprehensive cannabis license data platform. Emerald Intel customers can stay up to date through newsletters, alerts, and reports. Schedule a demo to explore the data directly.

Emerald Insights is the new name of the Cannacurio blog series, the industry’s trusted source for timely, data-driven analysis of cannabis licensing and regulatory trends. Catch up on all the great insights from Cannacurio here.