Emerald Insights #125: 2025 Cannabis Cultivation License Leaderboards

Emerald Insights is the new name of the Cannacurio blog series & podcast, the industry’s trusted source for timely, data-driven analysis of cannabis licensing and regulatory trends.

Executive Summary

Cultivation licenses continue to dominate the U.S. cannabis license landscape. At year-end 2025, 45% of all active cannabis licenses were cultivation licenses. Not all are operational, and numerous regulators and analysts have documented persistent oversupply across mature markets.

Key Findings

In 2025, the number of active cultivation licenses declined meaningfully:

-

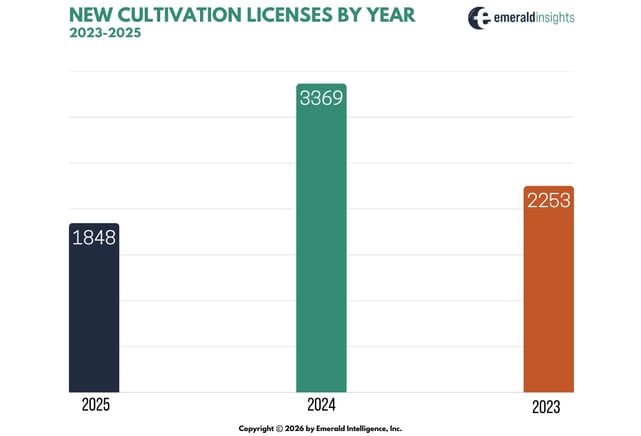

1,848 new cultivation licenses were issued, down from 3,369 in 2024.

-

Total active cultivation licenses fell from 18,630 in January to 17,013 in December, a decline of 8.6%.

-

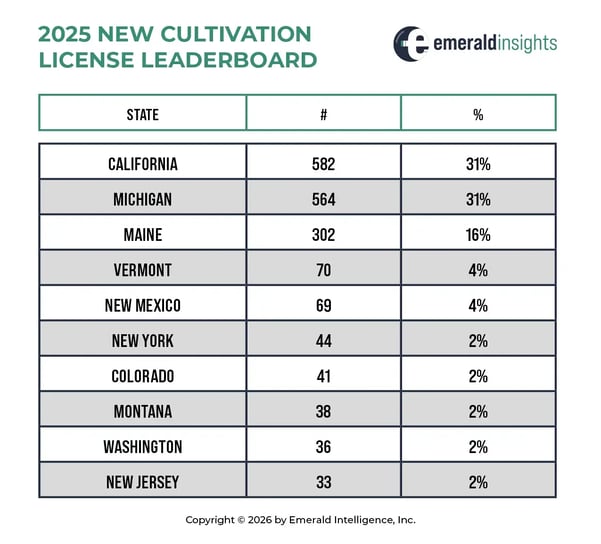

California added 582 new cultivation licenses, with Michigan close behind at 564.

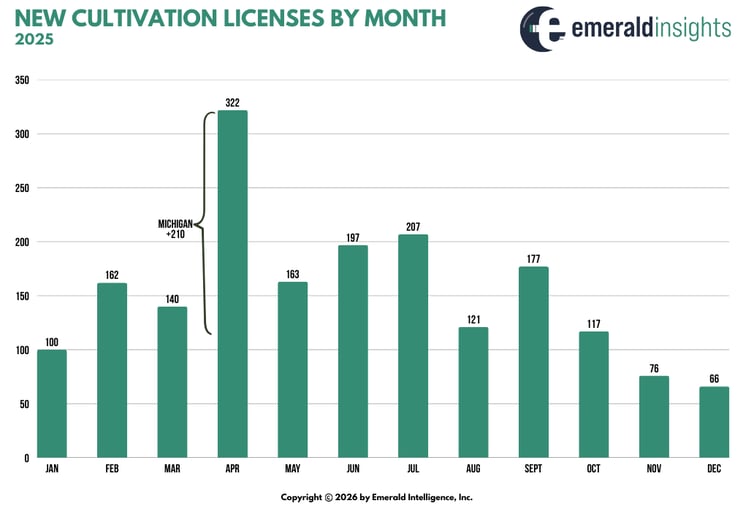

Monthly issuance data shows new cultivation licenses generally ranged between 100 and 200 per month, with a notable spike in April driven by Michigan. Issuance tapered in the fourth quarter, reinforcing broader contraction trends.

And here is the Top 10 Leaderboard for new cultivation licenses:

Ratio of Licenses to Facilities: Key States

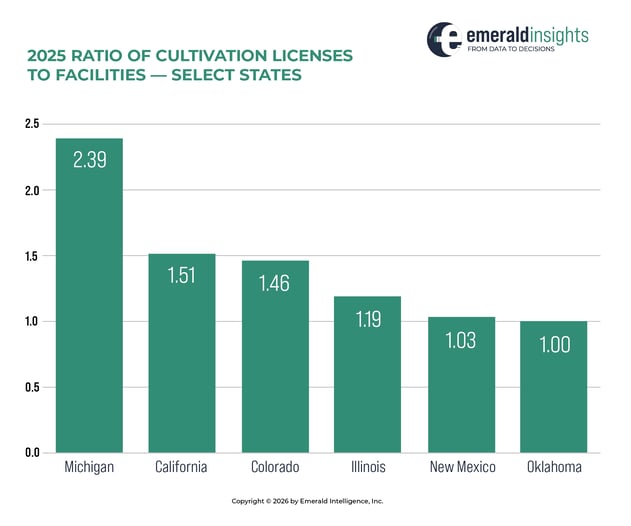

In addition to tracking licenses, we also keep track of the number of facilities/locations because in some states cultivators are able to have multiple licenses at one farm. The following graph highlights 6 key states:

A few observations:

-

Michigan has been a top issuer for the last few years and there are some facilities with many licenses in the state.

-

California was the leader here in the early days when they required separate medical and adult licenses; and required operators to hold small to medium sized plots. Their large licenses options are reducing the number of state licenses.

-

Oklahoma had few controls when the program was launched with no restrictions on canopy size – hence the neat 1-to-1 ratio of licenses to facilities.

The key point is that licenses are just one proxy to measure the industry. Looking at the number of businesses and how they relate to each other within a state and beyond is critical to understanding market dynamics.

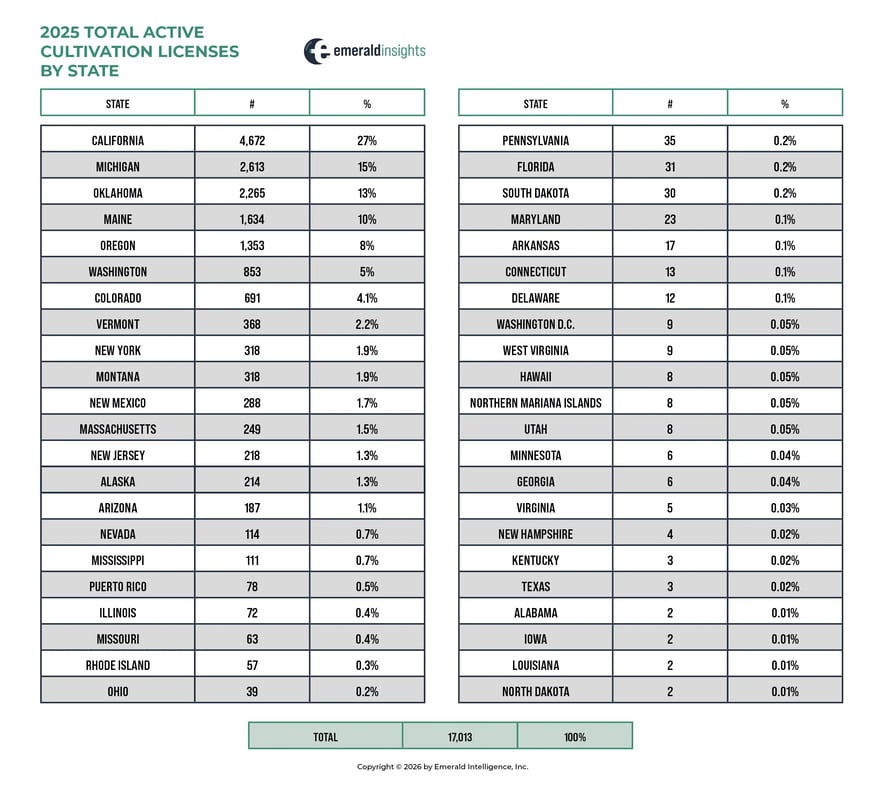

National View: Total Active Cultivation Licenses

California still holds the nation’s largest number of cultivation licenses. Michigan’s steady growth has allowed it to surpass Oklahoma, reflecting a shuffling of the national hierarchy.

But what unites all three markets — despite their size differences — is oversupply. Each state is grappling with too much canopy and inconsistent demand growth, leading regulators to reassess how much new production the market can sustain. Oklahoma’s governor has been talking about shutting the whole program down.

Conclusion

If Q3 signaled a shift toward tighter supply management, year-end data confirms it. In 2025, new cultivation issuance fell 45% compared to 2024, and total active cultivation licenses declined 8.6% — from 18,630 in January to 17,013 in December. Issuance tapered in the fourth quarter, underscoring that the market is no longer in broad expansion mode. For the first time in several years, contraction was not anecdotal — it was measurable.

While California and Michigan accounted for the majority of new licenses issued in 2025, most mature markets are now operating under explicit supply constraints. Moratoriums and canopy adjustments reflect a growing regulatory emphasis on stabilization. Even in high-issuance states, the broader context remains one of oversupply and margin compression rather than growth acceleration.

The cultivation sector has entered a normalization phase. Expansion is no longer the defining characteristic of the national market; calibration is. Heading into 2026, the focus shifts from license growth to license durability — attrition, consolidation, capital discipline, and how tightly regulators manage incremental supply. Cultivation remains the backbone of the license landscape, but 2025 made clear that equilibrium — not expansion — is now the industry’s organizing principle.

Author

Ed Keating spearheads Emerald Intel’s engagement with regulators worldwide, gathering and analyzing corporate, financial, and licensing data to map the evolving cannabis landscape. He is the author of the Emerald Insights blog and host of the Cannacurio podcast. Ed holds a degree from Hamilton College and earned his MBA from the Kellogg School of Management at Northwestern University. He currently serves as Chief Economist at Emerald Intel.

Emerald Insights is an episodic column from Emerald Intel featuring insights from the most comprehensive cannabis license data platform. Emerald Intel customers can stay up to date through newsletters, alerts, and reports. Schedule a demo to explore the data directly.

Emerald Insights is the new name of the Cannacurio blog series, the industry’s trusted source for timely, data-driven analysis of cannabis licensing and regulatory trends. Catch up on all the great insights from Cannacurio here.